In a post on Argmax the author described the current situation in which the IRS outsources debt collection. Within the next two weeks the IRS will turn over the tax information for over 12000 individuals who owe $25000 or less in tax debt. The IRS will still employ their own agents to collect larger debts, but they say that outsourcing the smaller debts to private sector companies is necessary because of constraints imposed by congress. Congress has told the IRS that they can not hire any new employees, which is why they are forced to outsource. They say that this will be much more expensive than using in house debt collectors.

The company that the IRS has hired to do most of the debt collection is the law firm of Linebarger Goggan Blair & Sampson. This firm has previously been under investigation for their collections practices. It is curious why the IRS would hire a company with a less than perfect track record. It is possible that they are having the word done at a low price due to so type of plea bargain or agreement resulting from the investigation. The most likely explanation for the outsourcing is that it is temporary. The immediate cost of hiring an outside firm is greater in the beginning, but these employees will only be paid until the debts are collected. If the IRS were to hire more employees they would have to keep them permanently and pay them even after the debts were all collected. The current program implemented by the IRS seems like an economically prudent solution.

Wednesday, April 25, 2007

The U.S. Economy

President George W. Bush had the following to say about the economy on Wall Street in New York City Wednesday, Jan. 31, 2007.

This statement speaks volumes about the current state of the economy in the United States. The three characteristics that the president mentioned are some of the most important factors in any formal economy. Each of these figures has a different and equally significant importance.

Keeping inflation low is important in any economy. If inflation is too high the value of the currency will decrease, prices will rise, and money shortages will occur. During the European hyperinflations of the early 90's several countries' economies were completely destroyed when the value of their money fell to near nothing. Unemployment level is also an important figure because it is usually an indicator of the strength of the economy. High umenplyment implies that the Fed is implementing a tight money policy and the money supply is low.

"When people across the world look at America's economy what they see is low inflation, low unemployment, and the fastest growth of any major industrialized nation," said the President. "The entrepreneurial spirit is alive and well in the United States."

This statement speaks volumes about the current state of the economy in the United States. The three characteristics that the president mentioned are some of the most important factors in any formal economy. Each of these figures has a different and equally significant importance.

Keeping inflation low is important in any economy. If inflation is too high the value of the currency will decrease, prices will rise, and money shortages will occur. During the European hyperinflations of the early 90's several countries' economies were completely destroyed when the value of their money fell to near nothing. Unemployment level is also an important figure because it is usually an indicator of the strength of the economy. High umenplyment implies that the Fed is implementing a tight money policy and the money supply is low.

The Real Bills Doctrine (Paper 3)

A great explanation of the real bills doctrine is delivered in the writings by Mike Sproul. He gives a watertight argument for the theory complete with background information about the terms associated. This article is divided into eight sub categories which each provide useful information. The author discusses the history of money and how it relates to backed money, fiat money, and the real bills doctrine. This website is especially useful because it gives a complete discussion of the real bills doctrine. The author even included response from his colleagues which both agreed and disagreed with him. This source is much more reliable than most others on the web because it focuses on more than one specific aspect of the theory. Mr. Sproul has covered all aspects of the real bills doctrine and gives a compelling argument. He believes that the failure of economists to understand the real bills doctrine is what has led to economics catastrophes such as recessions, depressions, inflation, and currency crises. There is already a post on my blog about this theory, so I will not bore you with details. Anyone interested in understanding monetary policy and inflation should begin with reading this paper.

The Quantity Thoery of Money (Paper 3)

The article "The Quantity Theory of Money" discusses the history, rationale, and founders of the theory. This writing first gives an example of the equation that represents the quantity theory. It then lists some of the famous economists that have backed this idea. The person who gave the most validity to the quantity theory was Irving Fisher, who is considered the father of modern economics. There is a lengthy explanation as to why the equation for the quantity theory works. The problem with this article is that the author is approaching the problem from a quantity theory perspective.

The flaws in this piece of writing begin with the equation MV=PT where "M" represents the money supply, "V" represents the velocity of money, "P" represents the price level, and "T" is the level of transactions. This equation assumes that "V" and "T" are fixed, and that an increase in the money supply will result in an increase in the price level which represents inflation. Some economists argue that "T" is not fixed. It could represent the amount of a product that is purchased with the new money plus old money, rather than the total amount of product purchased. For example, if a person received $500 in extra cash they would buy the same amount of toilet paper, but thy would use cash rather than a credit card or check. That would mean that "T" is not fixed and an increase in money supply would not necessarily result in an increase in price level. It is reckless for the author to prove his point based on an equation that has not been proven, therefore this entire theory should be discredited.

The flaws in this piece of writing begin with the equation MV=PT where "M" represents the money supply, "V" represents the velocity of money, "P" represents the price level, and "T" is the level of transactions. This equation assumes that "V" and "T" are fixed, and that an increase in the money supply will result in an increase in the price level which represents inflation. Some economists argue that "T" is not fixed. It could represent the amount of a product that is purchased with the new money plus old money, rather than the total amount of product purchased. For example, if a person received $500 in extra cash they would buy the same amount of toilet paper, but thy would use cash rather than a credit card or check. That would mean that "T" is not fixed and an increase in money supply would not necessarily result in an increase in price level. It is reckless for the author to prove his point based on an equation that has not been proven, therefore this entire theory should be discredited.

Wikipedia Entry

While searching wikipedia I found that there was no entry for a commonly used trem in economics. I started a page for the term and this is what I wrote.

A T account is a chart frequently used in accounting and economics. The name is derived from the distinctive T shape. This account lists the name of the account on top, assets or credits on the left side, and liabilities or debits on the right side. The goal of a t account is for total assets to equal total liabilities. For every adjustment made to one side there must be one or more equal adjustments made to the other side.

Example:

Receiving a bank loan of $100 would require two records on the account. The $100 cash received would be listed as asset on the left side, and the $100 owed back to the bank would be listed as a liability on the right side.

Alesina and Ichino: Women Should Pay Less Tax

The idea of raising taxes for men and lowering them for women is ridiculous. There are several problems with the logic presented in this article and I will explain each of them.

This sentence makes two unfair assumptions. The idea that changing taxes would discourage gender discrimination is a nice thought, but unrealistic. I hate the idea that only certain groups can be discriminated against. It is true that men dominate the workforce, but that does not mean that they cannot be discriminated against. Raising the tax for men and lowering it for women would further gender discrimination in another direction. If anything, this would draw a bold line between men and women in the workforce and cause tension.

The other unfair assumption is that women “bear the brunt of maternity.” This statement makes it seem as though women have no choice but to have children. Childrearing is a choice and should be treated as such. Women who decide to have children should be respected, but they should not be treated as victims. Having children may affect their professional careers, but this is a decision that each woman is free to make for herself and should be respected as such.

This statement can easily be refuted by a statement earlier in this same article. The author states that the labor supply of women is more sensitive to their after tax wage than men. If lowering the tax rate is expected to increase the labor supply of women, then raising the tax rate should be expected to lower the labor supply of women. The method described in the above statement would bring the workforce back to its current state.

It would also make gender discrimination more costly for employers and would be fair because it would compensate women for bearing the brunt of maternity and for the fact that the possibility of having children can negatively affect their career prospects.

This sentence makes two unfair assumptions. The idea that changing taxes would discourage gender discrimination is a nice thought, but unrealistic. I hate the idea that only certain groups can be discriminated against. It is true that men dominate the workforce, but that does not mean that they cannot be discriminated against. Raising the tax for men and lowering it for women would further gender discrimination in another direction. If anything, this would draw a bold line between men and women in the workforce and cause tension.

The other unfair assumption is that women “bear the brunt of maternity.” This statement makes it seem as though women have no choice but to have children. Childrearing is a choice and should be treated as such. Women who decide to have children should be respected, but they should not be treated as victims. Having children may affect their professional careers, but this is a decision that each woman is free to make for herself and should be respected as such.

If and when a change happens (and many social activists consider that a desirable goal), the response of male and female labor supply ... may become less different from each other... At that point, one may need to reconsider the differences in tax rates, precisely as the basic principles of optimal taxation suggest.

This statement can easily be refuted by a statement earlier in this same article. The author states that the labor supply of women is more sensitive to their after tax wage than men. If lowering the tax rate is expected to increase the labor supply of women, then raising the tax rate should be expected to lower the labor supply of women. The method described in the above statement would bring the workforce back to its current state.

Tuesday, April 24, 2007

Taxation Is Robbery (Response)

In his article "Taxation is Robbery," Frank Chodorov claims that when the government collects taxes it is committing robbery, and that a government is largely unnecessary. I strongly disagree with this point of view.

It is ludicrous to believe that taxation is robbery and unnecessary. It is true that tax revenue is taken from individuals unwillingly, but that revenue is used to pay for benefits that are necessary and would never be paid for voluntarily. I find it perplexing that the same people who are against taxation and government are the same people who promote universal health care and government assistance. Before anyone claims that taxes and government are unnecessary, take a moment to think about what this country would be like without the luxuries that are paid for with tax revenue. Developed cities, environmental regulations, trade agreements, the military, and the space program are all products of tax revenue. It is easy to see the benefit of abolishing tax because it is immediately gratifying. Extra money in your pocket would be nice, but that would come with a high price tag. Taxation is the price we pay for the freedoms that we enjoy. I agree that taxation might be excessive, but it is not unreasonable.

As far as the economy is concerned, taxation and government are absolutely necessary. Government funding has been used to subsidize everything from agriculture to the airline industry. It is the government’s ability to collect taxes that has spared this country from what may have been multiple recessions.

It is ludicrous to believe that taxation is robbery and unnecessary. It is true that tax revenue is taken from individuals unwillingly, but that revenue is used to pay for benefits that are necessary and would never be paid for voluntarily. I find it perplexing that the same people who are against taxation and government are the same people who promote universal health care and government assistance. Before anyone claims that taxes and government are unnecessary, take a moment to think about what this country would be like without the luxuries that are paid for with tax revenue. Developed cities, environmental regulations, trade agreements, the military, and the space program are all products of tax revenue. It is easy to see the benefit of abolishing tax because it is immediately gratifying. Extra money in your pocket would be nice, but that would come with a high price tag. Taxation is the price we pay for the freedoms that we enjoy. I agree that taxation might be excessive, but it is not unreasonable.

As far as the economy is concerned, taxation and government are absolutely necessary. Government funding has been used to subsidize everything from agriculture to the airline industry. It is the government’s ability to collect taxes that has spared this country from what may have been multiple recessions.

Comment on Angry Bear

It was easily predictable that at the end of the housing bubble, we’d see a lot of homes getting foreclosed. But there is nothing inherent in the end of a bubble that requires vast numbers of foreclosures. The reason we see them is that lenders made imprudent loans, and of course, that many people took those imprudent loans.

I have to slightly disagree with what you are saying. I see little relation between the current U.S. housing situation and the South American debt crisis. The idea that risky loans were given to South American countries is reasonable. The bankers that issued the loans would be immune to any repercussion long before the loan defaulted, because the terms on these types of loans span decades. The housing market in the U.S. will likely not see many foreclosures because the terms on home loans are much shorter. If a home loan defaults, it is likely that the issuing banker will still be employed at the bank when this occurs. This potential risk would cause bankers to be prudent in their lending practices. Hopefully most of the loans made during the housing boom were sound. If this is true there should be few foreclosures. The problem with the South American loans is that they were not used for their intended purpose. Based on the recent housing boom in the U.S. one could conclude that most of the home loans issued were actually used to purchase homes. These borrowers used the money to produce something of value that can be taken away if they default. This is not the case with the South American countries.

Monday, April 23, 2007

My Position

After studying the different points of view it has become apparent that the amount of money in circulation has nothing to do with inflation rates, and the quantity theory of money is false. There is a lesser known theory that I believe presents a much more reasonable explanation for inflation. The real bills doctrine is a theory that describes inflation as a product of improperly backed money. According to the real bills doctrine, if the backing for a currency is sufficient there will be no inflation. Under this model there is no limit to how much money can be created. This school of thought believes that anything that has value is acceptable as backing for currency. IOU’s, collateral, or anything that has value equal to that of the currency issued is sufficient backing for money. The backing for money is what the currency is exchangeable for. The real bills doctrine is in contrast to the quantity theory which supports the idea that gold is the only acceptable backing for currency. Violating the real bills doctrine is a more logical explanation for inflation than the quantity theory of money.

Web 2.0

Today's internet is an interactive, userfriendly environment. It has allowed individuals to work, socialize, and collaborate more effectively than ever before. Almost any task can be completed with one of the many prams available online. Moneytrackin' is one of the most usefull new programs available on the net today. It is a free online accounting software which is available to companies and individuals. Moneytrackin allows users to manage several different projects and accounts. The owner of an account can invite other users as collaborators. This allows projects teams with a grouop budget to manage their finances collectively and efficiently. The best feature of Moneytrackin is that it requires to program installation and can be accessed from anywhere. This feature enables individuals to uplaod their Quicken files to Moneytrackin and access them over the internet. Features such as this are unique to web 2.0. The archaic form of ledger accounting has been replaced with a more convenient and universal alternative.

Real Bills Doctrine

In my recent studies I have come accross a theory that has not recieved much recognition. I have since become deeply interested in the real bills doctrine. In order to explain the real bills doctrine I will give a hypothetical example. Imagine that there is a small town where every person uses gold as currency. If a person gives $100 worth of gold to the bank and receives $100 in paper money there will be no inflation. The $100 worth of gold is the backing for the $100 cash and gives it value. Any individual that is holding a paper dollar has the right to go to the bank and exchange it for a dollar worth of gold. Now assume that the bank lends $100 cash to a citizen who uses his house as collateral. The $100 that the bank lent would be exchanged for the citizen’s IOU and insured by the house. The IOU and the value of the house are backing the $100 dollars cash. The bank’s assets are increased just as much as its liabilities and there would be no inflation (Sproul). Either gold or bank loans can serve as a basis for money creation (Timberlake). This small town bank can issue as much currency as they would like as long as they have sufficient backing. Anything that is of value can be used to back currency. Another example of backing is tax revenue receivable. Assume that the town is certain that they will collect $500 in tax revenue within the next year. The town bank could issue $500 of cash and back it with the $500 in taxes receivable. The real bills doctrine would say that this town bank can continue issuing money in this manner without experiencing any inflation. Anything that the town can claim on a balance sheet as an asset is an acceptable form of backing for currency. The only way that inflation would occur is if the bank issued money that they did not have any backing for.

Literary Review

In the article “Predicting Inflation: Does The Quantity Theory Help?”, the authors give their opinion from a quantity theory perspective, which is one of the most popular schools of thought. This article discusses studies in which mathematical forecasting methods were used. The authors believe that the supply of money in circulation is positively related to the price of goods and the inflation rate. This is the popular belief amongst economists today.

Another source that I found was “The Evolution of Money.” This article takes a harsh stance against the current US monetary policy and the creation of paper money. The author states “for money to have worth, it must be relatively scarce, which explains why today's dollar is so unstable.”(McManus). The author tries to state his opinion as a rule, but he fails to give any reference or support for his claim. This article makes some other unsubstantiated claims.It says that whatever is used as money must possess a tangible value. Gold is the best material to use as money. Silver and platinum could be used, but they are not as good as gold (McManus). It is unreasonable to assume that gold is any better than platinum as currency. Platinum is more scarce and more valuable than gold. According to the logic that is presented in this article, platinum should be a better material for currency than gold. There was one other quote that was ill used. Irving Fisher said “"The quantity theory of money thus rests, ultimately, upon the fundamental peculiarity which money alone of all human goods possesses - the fact that it has no power to satisfy human wants except a power to purchase things which do have such power". This quote was intended to support the quantity theory, but I see it as the opposite. If money can only be used to purchase goods that satisfy wants, then paper money is just as valuable as gold. These are just some examples of the way quantity theorists defend their position that gold is the only suitable backing for money. The quantity theory of money has been seen as the correct explanation for inflation for many years. It is believed that increasing the quantity of money will cause inflation even if the money is backed. Most of the articles that I read stated that the quantity theory, unemployment rate, or other factors were to blame for inflation. Most textbooks promote the quantity theory of money and do not even mention the real bills doctrine. The ones that do mention the RBD usually discredit it (Sproul). I found very few articles that promoted the real bills doctrine. It is a lesser known theory and is not widely accepted in the economics field.

Another source that I found was “The Evolution of Money.” This article takes a harsh stance against the current US monetary policy and the creation of paper money. The author states “for money to have worth, it must be relatively scarce, which explains why today's dollar is so unstable.”(McManus). The author tries to state his opinion as a rule, but he fails to give any reference or support for his claim. This article makes some other unsubstantiated claims.It says that whatever is used as money must possess a tangible value. Gold is the best material to use as money. Silver and platinum could be used, but they are not as good as gold (McManus). It is unreasonable to assume that gold is any better than platinum as currency. Platinum is more scarce and more valuable than gold. According to the logic that is presented in this article, platinum should be a better material for currency than gold. There was one other quote that was ill used. Irving Fisher said “"The quantity theory of money thus rests, ultimately, upon the fundamental peculiarity which money alone of all human goods possesses - the fact that it has no power to satisfy human wants except a power to purchase things which do have such power". This quote was intended to support the quantity theory, but I see it as the opposite. If money can only be used to purchase goods that satisfy wants, then paper money is just as valuable as gold. These are just some examples of the way quantity theorists defend their position that gold is the only suitable backing for money. The quantity theory of money has been seen as the correct explanation for inflation for many years. It is believed that increasing the quantity of money will cause inflation even if the money is backed. Most of the articles that I read stated that the quantity theory, unemployment rate, or other factors were to blame for inflation. Most textbooks promote the quantity theory of money and do not even mention the real bills doctrine. The ones that do mention the RBD usually discredit it (Sproul). I found very few articles that promoted the real bills doctrine. It is a lesser known theory and is not widely accepted in the economics field.

Wednesday, March 28, 2007

Traditional vs. Online Resources

In my short lifetime I have seen the progression of technology and how it has changed our world. Computers are now integrated into almost every aspect of daily life. I have noticed that my habits and practices have been dramatically altered by this technology.I still perform the same tasks as before, but in different ways. One task in particular that has changed is the way I perform academic research. The traditional method of doing research and citing sources is somewhat different from the electronic methods I use today.

Traditional research requires a lot of time and footwork. I used to use libraries as my main source of information. I can still remember the days when I used reference cards and the dewey decimal system. When I found a useful piece of information I would look inside the cover of the book and write down the bibliographical information on an index card. I would then write the quoted material on the other side of the card. This was effective, but it sometimes caused problems. I always felt that this system was unorganized. I also found that after time I would forget how the quote I referenced related to the rest of the book.

Electronic bibliographical tools such as Diigo and Zotero have made the process of citing information much easier and more organized. These two programs are useful for different reasons. With the click of a mouse Zotero will display the bibliographical information of a book or journal article in MLA format. This eliminates the factor of human error and ensures that the information is correct. Diigo is also quite useful. It allows the user to write comments on the article that is being referenced, which allows the reader to understand the context of a specific quote. These electronic tools perform the same tasks as traditional methods, but with more efficiency. It is amazing to think that a web page that can be accessed from anywhere can take the place of a stack of books and index cards. Both traditional and modern bibliographies perform the same function, but they work in very different ways.

Traditional research requires a lot of time and footwork. I used to use libraries as my main source of information. I can still remember the days when I used reference cards and the dewey decimal system. When I found a useful piece of information I would look inside the cover of the book and write down the bibliographical information on an index card. I would then write the quoted material on the other side of the card. This was effective, but it sometimes caused problems. I always felt that this system was unorganized. I also found that after time I would forget how the quote I referenced related to the rest of the book.

Electronic bibliographical tools such as Diigo and Zotero have made the process of citing information much easier and more organized. These two programs are useful for different reasons. With the click of a mouse Zotero will display the bibliographical information of a book or journal article in MLA format. This eliminates the factor of human error and ensures that the information is correct. Diigo is also quite useful. It allows the user to write comments on the article that is being referenced, which allows the reader to understand the context of a specific quote. These electronic tools perform the same tasks as traditional methods, but with more efficiency. It is amazing to think that a web page that can be accessed from anywhere can take the place of a stack of books and index cards. Both traditional and modern bibliographies perform the same function, but they work in very different ways.

Thursday, March 1, 2007

Annotations

Heavy Constraints on a "Weightless World"? Resources and the New Economy(Jonathan Perrington, The American Journal of Economics and Sociology, Jan 2006)

This article was published in the American Journal of Economics and Sociology. It addresses production trends that have been seen in industrialized countries since the late 1990's. Developed countries, namely the United States, have seen a shift from material production to service oriented production in recent years. The traditional thought is that a decrease in material production will result in decreased economic activity, and until the late 1990's this was true. In recent years the United States has seen decreased material production, but increased economic growth. This phenomenon was first seen with the emergence of the computer age. Goods such as computer software and programming are greatly contributing to the economy without physically producing anything. The need for information and technology is driving developed countries toward service oriented jobs. This article focuses on this unique situation and some of the factors and causes. The author also goes on to discuss the negative effect that this is having on developing countries who traditionally supply raw materials. Developed countries are now using human resources more than physical resources. The Unites States' reduced necessity for these resources has slowed economic activity in the countries that provide those resources. This article gives great insight into current conditions in the global economy.

Consumer Price Gauges Rise More Than Expected(Jeremy W. Peters, New York Times, Feb 22 2007)

The article "Consumer Price Gauges Rise More Than Expected" was written by Jeremy W. Peters and published in the New York Times. The Federal Reserve expected inflation to be low this year, but price increases in January have caused many analysts to become skeptical. During the month of January 2007 prices for several goods including fruit and hotel rooms increased dramatically. The rate of core inflation, as represented by the consumer price index, jumped from .1 percent in December to .3 percent in January. The effect of this inflation has already been seen in the market. Many investors have begun to push stock prices lower in preparation for interest rate changes. The Federal Open Market Committee met and decided that a change in interest rates was not necessary. The article goes on to explain relevant benchmarks in inflation rates. Anything above 2 percent raises concerns for the Federal Reserve. As long as rates are below this mark they will not consider raising or lowering interest rates. Inflation is currently at 2.1 percent, but the Federal Reserve has decided that this is not large enough to worry about. This article may be helpful to anybody involved in stock trading, banking, and real estate. Interest rates and inflation can effect all of these areas.

This article was published in the American Journal of Economics and Sociology. It addresses production trends that have been seen in industrialized countries since the late 1990's. Developed countries, namely the United States, have seen a shift from material production to service oriented production in recent years. The traditional thought is that a decrease in material production will result in decreased economic activity, and until the late 1990's this was true. In recent years the United States has seen decreased material production, but increased economic growth. This phenomenon was first seen with the emergence of the computer age. Goods such as computer software and programming are greatly contributing to the economy without physically producing anything. The need for information and technology is driving developed countries toward service oriented jobs. This article focuses on this unique situation and some of the factors and causes. The author also goes on to discuss the negative effect that this is having on developing countries who traditionally supply raw materials. Developed countries are now using human resources more than physical resources. The Unites States' reduced necessity for these resources has slowed economic activity in the countries that provide those resources. This article gives great insight into current conditions in the global economy.

Consumer Price Gauges Rise More Than Expected(Jeremy W. Peters, New York Times, Feb 22 2007)

The article "Consumer Price Gauges Rise More Than Expected" was written by Jeremy W. Peters and published in the New York Times. The Federal Reserve expected inflation to be low this year, but price increases in January have caused many analysts to become skeptical. During the month of January 2007 prices for several goods including fruit and hotel rooms increased dramatically. The rate of core inflation, as represented by the consumer price index, jumped from .1 percent in December to .3 percent in January. The effect of this inflation has already been seen in the market. Many investors have begun to push stock prices lower in preparation for interest rate changes. The Federal Open Market Committee met and decided that a change in interest rates was not necessary. The article goes on to explain relevant benchmarks in inflation rates. Anything above 2 percent raises concerns for the Federal Reserve. As long as rates are below this mark they will not consider raising or lowering interest rates. Inflation is currently at 2.1 percent, but the Federal Reserve has decided that this is not large enough to worry about. This article may be helpful to anybody involved in stock trading, banking, and real estate. Interest rates and inflation can effect all of these areas.

Monday, February 19, 2007

Social Bookmarks

I searched Diigo for bookmarks that are tagged with the word "economics". I found one person in paricular that had several bookmarks with this tag. Technicolorcvlry's list of bookmarks is not long, but 13 of them are tagged with economics and are of relevance to my field of study. There are some aspects of his annotations that I like, but there is some room for improvement.

The best thing about these annotations is that they are short and to the point. Each annotation is no more than a sentence. They give a clear description of the content of the source. This person was sure not to give a long critique of the site listed. The annotation tells a little about the website, but leaves the reader to come to their own conclusion about the content. The conciseness of the annotations is the best feature of this list of bookmarks.

The downside of having short annotations is that it does not provide much insight as to the content of the link. These short annotations provide little more information than the title of the link. It would be much more helpful if the author of the annotations would explain what type of information was contained in the link. The author should tell whether the source is scholarly or not. They should also discuss whether the link is an editorial, a survey, or just the musings of an individual. It would also be useful if the annotations discussed the author of the link and their credibility.

The best thing about these annotations is that they are short and to the point. Each annotation is no more than a sentence. They give a clear description of the content of the source. This person was sure not to give a long critique of the site listed. The annotation tells a little about the website, but leaves the reader to come to their own conclusion about the content. The conciseness of the annotations is the best feature of this list of bookmarks.

The downside of having short annotations is that it does not provide much insight as to the content of the link. These short annotations provide little more information than the title of the link. It would be much more helpful if the author of the annotations would explain what type of information was contained in the link. The author should tell whether the source is scholarly or not. They should also discuss whether the link is an editorial, a survey, or just the musings of an individual. It would also be useful if the annotations discussed the author of the link and their credibility.

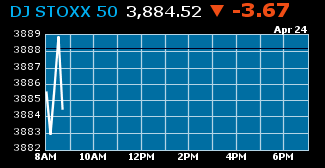

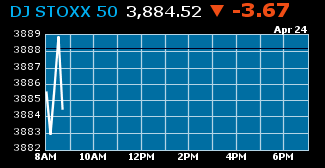

Visual Representation

There are many useful online resources for economists, but Bloomberg.com has to be the best. It is a website that delivers the latest financial, economic, and business news. One of the most impressive aspects of this website is the visual appeal. Anyone can print simple black and white text, but Bloomberg manages to organize and display their information in a pleasing, user-friendly environment. They have achieved this in the following way.

The first thing that catches one's eye is the "Breaking News" section on the website. This is displayed at the top of the page and contains the titles of all the latest articles. The list is presented in bullet point format with as few words as possible, which gives the reader an idea as to what the article is about, but does not complicate the page with a long description. These small text formatting details make the information easy for readers to navigate and understand. Along with text formatting, the website also makes use of graphics. The most obvious use of graphics is in the right column of the website's main page, which is where they provide graphs and charts of market activity. The use of charts and graphs makes the information easy to read. This would be much more difficult if the information were listed in simple text. The charts show the names of the markets on the left and the important variables along the top row.

This is an example of the various visual effects that Bloomberg uses. This small graph conveys as much meaning as a lengthy paragraph. The information in the graph shows the price level of the stock and is updated each hour. At the top of the graph there is information about the stock that is color coded and boldly displayed. The text color and font size changes with the importance of the information. The current price of the stock is white, while the stock symbol is blue and bold. The change in price is in the largest font and displayed in either red on blue font, depending upon whether the stock prices falls or rises. The use of fonts, colors, and graphics allows the creators of Bloomberg to streamline their information deliver clear content to their users. This current writing s an example of the advantages that graphics provide. All of the information in this paragraph is also displayed in the graph above, but in a more convenient and easy to read format.

The graphic appeal of Bloomberg.com reaches farther than just the opening page. Clicking on one of the several tabs along the top of the page bring the user to different pages on the website. Under the "market data" tab there is a summary of all the important economic figures. These are subdivided into markets, currency, today's top funds, and commodities, and are highlighted in blue. The information under these headings are highlighted in white and blue alternately. This adds some aesthetic appeal and helps the reader to keep their place on the page.The overall layout of Bloomberg contributes to this purpose. The use of fonts, colors, and images makes the information understandable and easy to navigate.

The first thing that catches one's eye is the "Breaking News" section on the website. This is displayed at the top of the page and contains the titles of all the latest articles. The list is presented in bullet point format with as few words as possible, which gives the reader an idea as to what the article is about, but does not complicate the page with a long description. These small text formatting details make the information easy for readers to navigate and understand. Along with text formatting, the website also makes use of graphics. The most obvious use of graphics is in the right column of the website's main page, which is where they provide graphs and charts of market activity. The use of charts and graphs makes the information easy to read. This would be much more difficult if the information were listed in simple text. The charts show the names of the markets on the left and the important variables along the top row.

This is an example of the various visual effects that Bloomberg uses. This small graph conveys as much meaning as a lengthy paragraph. The information in the graph shows the price level of the stock and is updated each hour. At the top of the graph there is information about the stock that is color coded and boldly displayed. The text color and font size changes with the importance of the information. The current price of the stock is white, while the stock symbol is blue and bold. The change in price is in the largest font and displayed in either red on blue font, depending upon whether the stock prices falls or rises. The use of fonts, colors, and graphics allows the creators of Bloomberg to streamline their information deliver clear content to their users. This current writing s an example of the advantages that graphics provide. All of the information in this paragraph is also displayed in the graph above, but in a more convenient and easy to read format.

The graphic appeal of Bloomberg.com reaches farther than just the opening page. Clicking on one of the several tabs along the top of the page bring the user to different pages on the website. Under the "market data" tab there is a summary of all the important economic figures. These are subdivided into markets, currency, today's top funds, and commodities, and are highlighted in blue. The information under these headings are highlighted in white and blue alternately. This adds some aesthetic appeal and helps the reader to keep their place on the page.The overall layout of Bloomberg contributes to this purpose. The use of fonts, colors, and images makes the information understandable and easy to navigate.

Tuesday, January 30, 2007

Examining Resources(1)

During the course of creating this blog I have found some helpful and interesting resources. I have also found that some resources are less useful than I had originally believed. Blogs and websites can provide useful information and an insider's view of the economics field. Websites have been the most helpful resources for me. They provide scholarly and accurate information. Most of the resources that I have used are updated daily with the most current information. The following is a list of my resources and a description of the type of information that they provide. These are not all of my resources, but they are the ones that differ most substantially from the others.

-Bloomberg

This website is constantly referenced by professionals in the economics, finance, and investing fields. Bloomberg is the leading provider of data and news. They provide current and historical financial data, market data, and pricing. One of the most useful resources that they provide is an economic calendar. This calendar announces when reports, indexes, and announcements are released. They also give links to all of the information on the calendar. The main function of this website is to provide news that is related to finance and the economy. This is a great tool for people who want to focus only on this type of news. Bloomberg is frequently used by professionals in the field. This is often the source where bloggers find information that fuels their discussions.

-CNN

CNN is another useful resource. They provide almost the same information as Bloomberg. CNN is a reliable news source. The only shortcoming of CNN is that they provide a wide variety of news. They cover everything from sports to weather. It is for this reason that economists do not use CNN as their primary source. The economic information that they provide is useful, but it is designed to appeal to a wide variety of viewers.

-Economist.com

I have found that this website is not as helpful as some of the others that I have referenced. The focus of economist.com seems to be more global than any of the others. From what I have read it appears that the content focuses on political issues. There is a lot of coverage of current events and the war in Iraq. This website is not intended for those who have extensively studied economics. The function of this site is mainly to provide commentary on social and political issues. Most bloggers would be unlikely to reference this site because it does not deliver very important news.

Blogs have provided a different type of information. Bloggers do not attempt to deliver the latest news. They realize that the large networks are capable of performing more quickly and more accurately. However, blogs do provide something that the news networks cannot compete with. Blogs allow many people to share their individual views with the whole world. The following are some of the blogs that I have linked to my blog as resources.

-Economist's View

This is the most interesting blog that I have read to date. This blog offers current economic issues and commentary on those issues. The content of this blog is relevant to the economics field. The two authors are economics professors, which gives a sense of credibility to everything that they post. The blog is academic and written in a professional manner. The authors appear to be in touch with their colleagues in the field of economics. They have a very long blog roll and many people have linked their own blogs to this one. Economist's view effectively uses portions of online resources and analyzes the information.

-Mises Economics Blog

I expected more economics related material from this blog than what I have seen. The title would suggest that economics is the primary topic of this blog. The reality is that only about 30 percent of the posts that I have read are related to economics. This blog does not report on the latest findings in the field. It appears that this blog is of a more personal nature than most others. The posts that are related to economics are engaging, but the rest of the posts are rants about the war and government. The content of this blog attempts to be academic, but I have a hard time believing everything that is posted. The most important purpose of this blog is to provoke thought. A few topics have caught my interest because of this blog.

-Bloomberg

This website is constantly referenced by professionals in the economics, finance, and investing fields. Bloomberg is the leading provider of data and news. They provide current and historical financial data, market data, and pricing. One of the most useful resources that they provide is an economic calendar. This calendar announces when reports, indexes, and announcements are released. They also give links to all of the information on the calendar. The main function of this website is to provide news that is related to finance and the economy. This is a great tool for people who want to focus only on this type of news. Bloomberg is frequently used by professionals in the field. This is often the source where bloggers find information that fuels their discussions.

-CNN

CNN is another useful resource. They provide almost the same information as Bloomberg. CNN is a reliable news source. The only shortcoming of CNN is that they provide a wide variety of news. They cover everything from sports to weather. It is for this reason that economists do not use CNN as their primary source. The economic information that they provide is useful, but it is designed to appeal to a wide variety of viewers.

-Economist.com

I have found that this website is not as helpful as some of the others that I have referenced. The focus of economist.com seems to be more global than any of the others. From what I have read it appears that the content focuses on political issues. There is a lot of coverage of current events and the war in Iraq. This website is not intended for those who have extensively studied economics. The function of this site is mainly to provide commentary on social and political issues. Most bloggers would be unlikely to reference this site because it does not deliver very important news.

Blogs have provided a different type of information. Bloggers do not attempt to deliver the latest news. They realize that the large networks are capable of performing more quickly and more accurately. However, blogs do provide something that the news networks cannot compete with. Blogs allow many people to share their individual views with the whole world. The following are some of the blogs that I have linked to my blog as resources.

-Economist's View

This is the most interesting blog that I have read to date. This blog offers current economic issues and commentary on those issues. The content of this blog is relevant to the economics field. The two authors are economics professors, which gives a sense of credibility to everything that they post. The blog is academic and written in a professional manner. The authors appear to be in touch with their colleagues in the field of economics. They have a very long blog roll and many people have linked their own blogs to this one. Economist's view effectively uses portions of online resources and analyzes the information.

-Mises Economics Blog

I expected more economics related material from this blog than what I have seen. The title would suggest that economics is the primary topic of this blog. The reality is that only about 30 percent of the posts that I have read are related to economics. This blog does not report on the latest findings in the field. It appears that this blog is of a more personal nature than most others. The posts that are related to economics are engaging, but the rest of the posts are rants about the war and government. The content of this blog attempts to be academic, but I have a hard time believing everything that is posted. The most important purpose of this blog is to provoke thought. A few topics have caught my interest because of this blog.

Thursday, January 25, 2007

Bruce Bartlett and Tyler Cowen on Inequality

If my real income does not fall, how am I hurt when Bill Gates makes another billion dollars? After all, the economic pie is not fixed. What he gets doesn’t come at my expense, so why should I or anyone else care? ...

- I have always thought about the subject in this way. I do not think that the rich making more money is contributing the poverty of others.

- post by tbentson

If it were costless to play Robin Hood and take from the rich and give to the poor, it would be hard to oppose. But there are costs. We really don’t want the Gateses of the world sitting around clipping coupons. We want them out there thinking of new products and businesses to make themselves richer, because in the process they will improve the quality and lower the prices of goods and services we use, employ workers ..., and so on.

- I belive that there is a great cost to overtaxing the rich. The rich business owners such as Bill Gates greatly stimulate our economy. Every dollar that Bill Gates makes represents one dolllar that a consumer spent on a Microsoft product. That means that every person in the supply chain between Microsoft and the consumer made a profit. There are countless amounts of people that are employes by large corporations. If the rich were excessively taxed they may be forced to downsize their operations. Every copy of Microsoft Windows that is sold employes many people. There are programmers that develop the product, assembly line workers that create and package the procuct, and drivers that ship the product. Retailers of their product also depend on Microsoft for a portion of their income. Taxing the rich will not close the wealth gap in this country. It will lower the wealth of the rich and in turn lower the amount of wealth that they provide to their workers. Everybody will be less wealthy.

- post by tbentson

Furthermore, more-educated groups show greater income inequality than less-educated groups. Uneducated people are more likely to be clustered in a tight range of relatively low incomes. But the educated will include a greater range of highly motivated breadwinners and relaxed bohemians, and a greater range of winning and losing investors. A result is a greater variety of incomes. Since the United States is growing older and also more educated, income inequality will naturally rise.

- This is a reasonable explanation for income inequality. The rich are not the ones to blame for this gap. They are simply people who made better decisions somewhere in their lives. I believe that some of their wealth is also due to luck.

- post by tbentson

Tuesday, January 23, 2007

Validity of Online Resources(2)

Blogs are some of the most useful resources on the internet. They provide unfiltered information that comes from a diverse group of people. There is one blog in particular that is helpful in my study of economics. The blog that I am going to examine is Economist's View. This blog is based entirely on economics. It provides economic commentary on current issues. The blog is written by Mark Thoma and Tim Duy. They are both economics professors at the University of Oregon. As economics professors, they are both actively involved in their field. I trust the information that is presented on this blog because I trust the authors. They understand the traditional view of economics and all of the terms and history associated with the profession. Their daily jobs require that they stay informed of the latest breakthroughs in their profession. From what I have seen on their blog it looks like they post several times daily. It is clear that the authors devote much of their time to maintaining this blog. Their blog seems to be very popular. They have a technorati ranking of 3233.

I am very fond of this blog because it closely relates to my field of study.I am an economics student and this blog is written by economics professors. It focuses on current issues and the effects that they may have on the economy. This work is very scholarly. The two writers of this blog are college professors which would almost certainly make it academic. The posts on this blog are extremely detailed. They cite legitimate resources and provide all of the background information needed to understand each post. The posts are much longer than most of the other blogs that I have seen. Their audience seems to be people who already have some knowledge of how the economy works. It is aimed towards people who want to extensively study economics. I believe that this blog will be a great resource for feeding my blog. They discuss issues that are similar to those that I am planning on covering. This blog is updated daily and will be a great resource for me. If everything goes according to plan my blog will not differ much from theirs. I think that this blog is great and I would like to produce something similar.

The greatest aspect of this blog is that it avoids becoming stale. It is easy for economics to become boring when exchange rates and numerical figures are the sole topic of discussion. I am amazed that the authors of "Economist's View" have been able to add a personal touch to the field of economics. The post entitled "Is the High Vacancy Rate for Housing Worrisome?" is a great example of how the author relates the material to the reader.

This information is presented in a matter that makes it useful to the reader. Most economists would report on this subject and discuss all of the numbers and technical aspects that are involved. The writers of this blog chose to discuss the effects of a high vacancy rate. The language used makes this blog useful to anyone that is interested in economics. Having some background knowledge might be useful, but it is not required in order to understand this blog.

I am very fond of this blog because it closely relates to my field of study.I am an economics student and this blog is written by economics professors. It focuses on current issues and the effects that they may have on the economy. This work is very scholarly. The two writers of this blog are college professors which would almost certainly make it academic. The posts on this blog are extremely detailed. They cite legitimate resources and provide all of the background information needed to understand each post. The posts are much longer than most of the other blogs that I have seen. Their audience seems to be people who already have some knowledge of how the economy works. It is aimed towards people who want to extensively study economics. I believe that this blog will be a great resource for feeding my blog. They discuss issues that are similar to those that I am planning on covering. This blog is updated daily and will be a great resource for me. If everything goes according to plan my blog will not differ much from theirs. I think that this blog is great and I would like to produce something similar.

The greatest aspect of this blog is that it avoids becoming stale. It is easy for economics to become boring when exchange rates and numerical figures are the sole topic of discussion. I am amazed that the authors of "Economist's View" have been able to add a personal touch to the field of economics. The post entitled "Is the High Vacancy Rate for Housing Worrisome?" is a great example of how the author relates the material to the reader.

The Census Bureau just released the data for fourth quarter of 2006. This showed the vacancy rate for owner occupied housing hitting 2.7 percent. This is up 50 percent from the 1.8 percent rate of two years ago.

This record vacancy rate is likely to mean considerably more downward pressure on house sale prices in the months ahead. It will likely mean downward pressure on rents as well, as some vacant units will eventually be put up for rent.

This information is presented in a matter that makes it useful to the reader. Most economists would report on this subject and discuss all of the numbers and technical aspects that are involved. The writers of this blog chose to discuss the effects of a high vacancy rate. The language used makes this blog useful to anyone that is interested in economics. Having some background knowledge might be useful, but it is not required in order to understand this blog.

Thursday, January 11, 2007

How does the economy effect me?(3)

Most people do not have a great understanding of the economy and how it works. They do not know about the economy because they do not care about the economy. Economics is generally portrayed as a study of figures, graphs, and estimates. It is difficult for most people to develop an interest in a discipline that they cannot relate to and does not effect their lives. The reality is that everybody is effected by the economy and everybody contributes to the economy in some way. With this blog I plan to examine how the economy effects the daily lives of the citizens of this country. Almost every foreign policy, political move, or social issue has some kind of economic impact. I will try to comment on such issues and explain how they will effect people's lives. Exchange rates, employment rates, and the Consumer Price Index are difficult for most people to understand. It is sometimes difficult to see the relevance of these numbers. For example, low interest rates may increase home values and a change in exchange rates may cause inflation. I will try to explain these figures in detail and speculate what the numbers may represent.

There are many analysts in the economics field that like to speculate. That is one of the most interesting aspects of economics. Every action is open to speculation. There can be numerous unexpected events that result from one single event. This allows economists to make many different predictions. I will provide an alternative view and comment on the speculations of others.

There are many analysts in the economics field that like to speculate. That is one of the most interesting aspects of economics. Every action is open to speculation. There can be numerous unexpected events that result from one single event. This allows economists to make many different predictions. I will provide an alternative view and comment on the speculations of others.

Subscribe to:

Posts (Atom)